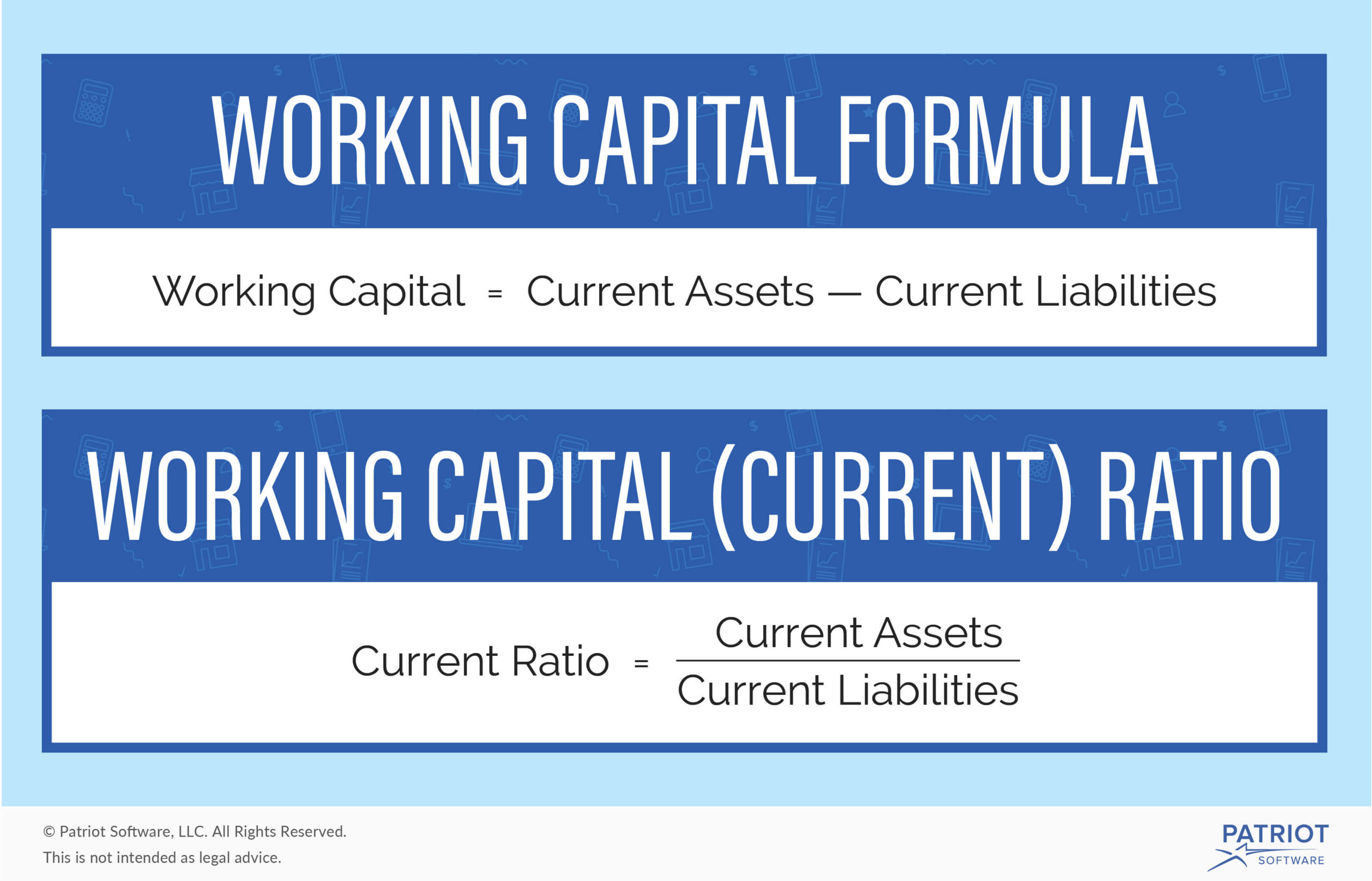

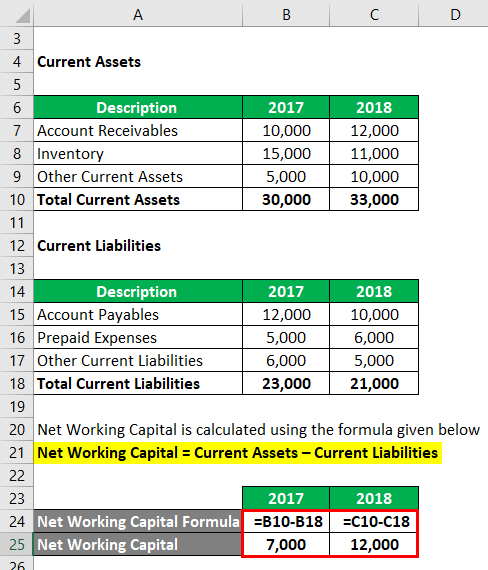

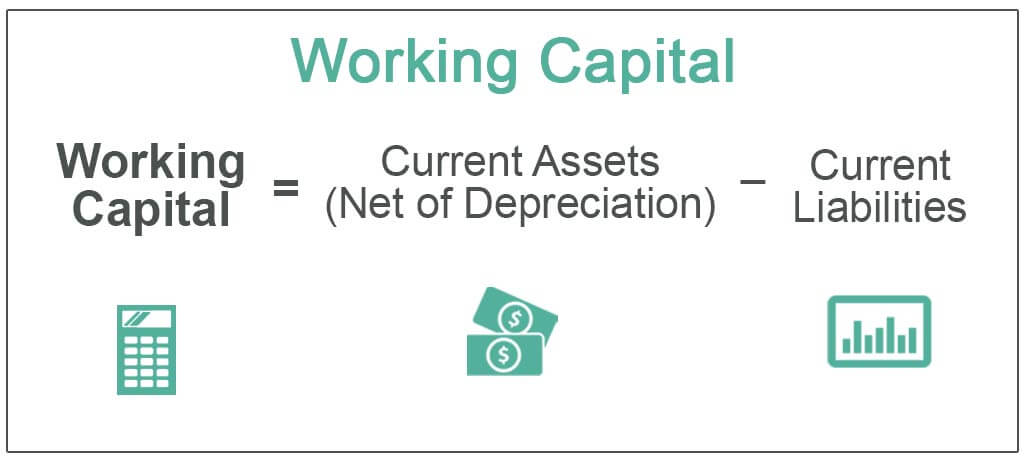

Simply put, working capital is current assets minus current liabilities and is the liquid part of the balance sheet (ie items that are settled in less than one year)The business's net working capital ratio would be calculated like this 100,000 cash 0,000 due from customers 50,000 inventory = 350,000 current assetsUnderstanding Working Capital Targets in M&A Transactions We have found that net working capital ("NWC") targets are one of the most commonly misunderstood

Working Capital Example Formula Definition Wall Street Prep

Level of working capital formula

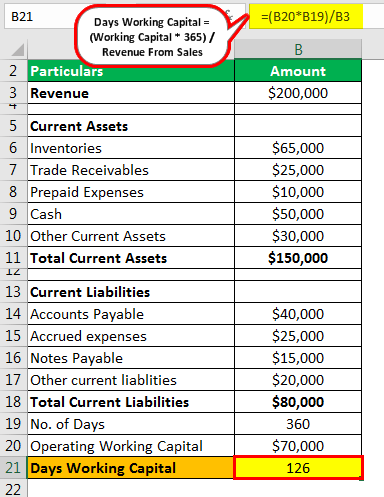

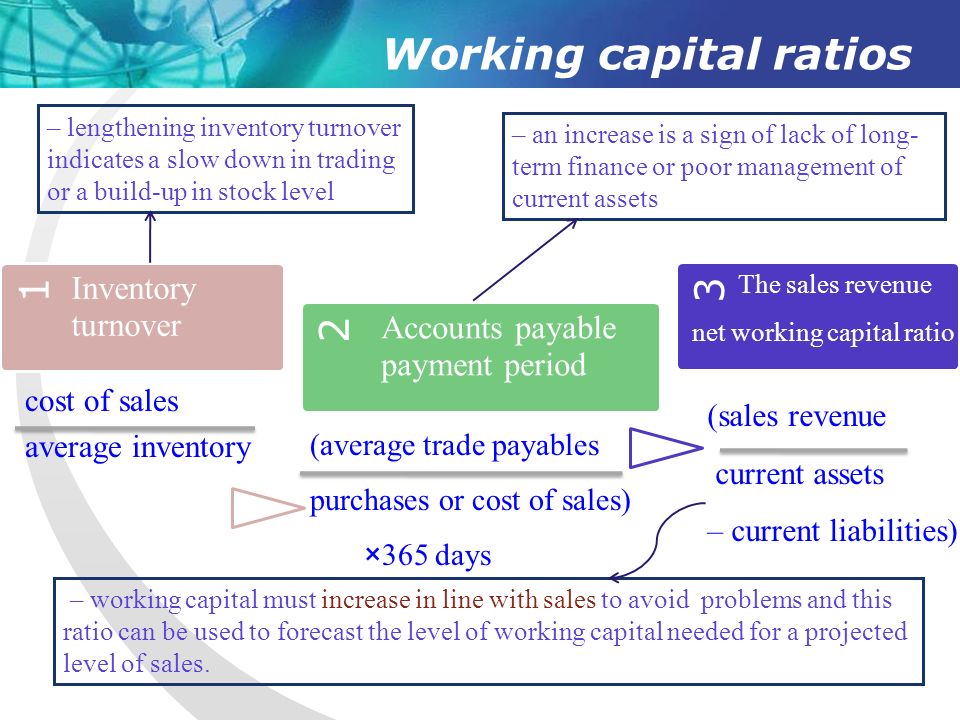

Level of working capital formula- Example of the Sales to Working Capital Ratio A credit analyst is reviewing the sales to working capital ratio of Milford Sound, which has applied for credit Working capital is a good indicator of how your company's inventory, accounts receivable, accounts payable, and cash on hand are being managed If these accounts are

Frm Working Capital Hpq Example Youtube

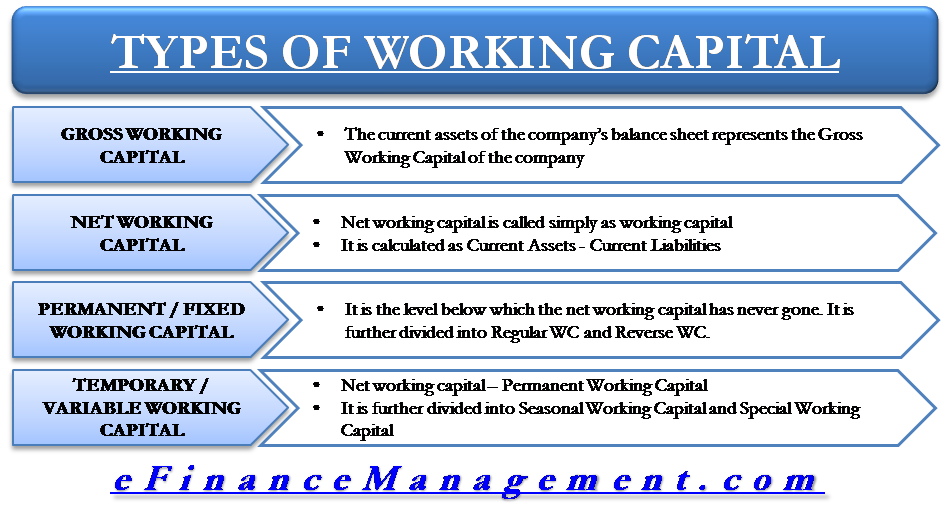

Determining a Good Working Capital Ratio The ratio is calculated by dividing current assets by current liabilities It is also referred to as the current ratio There is no formula for calculating the exact permanent working capital It is an estimation based on the experience of the entrepreneur Statistical data on the balanceThe following tables illustrate typical working capital trends seen in these categories Working capital amounts can be small at one company and quite significant at

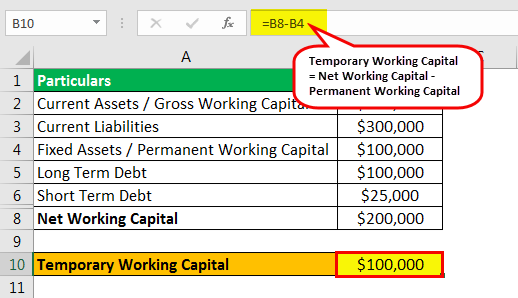

The formula is How to Interpret Working Capital Under the best circumstances, insufficient working capital levels can lead to financial pressures on a Negotiating working capital is one of the most contentious issues in closing a deal That's because determining the amount of sufficient working capital needed to Excess working capital carries the 'carrying cost' or 'interest cost' on the capital lying unutilized Shortage of working capital carries 'shortage cost' which

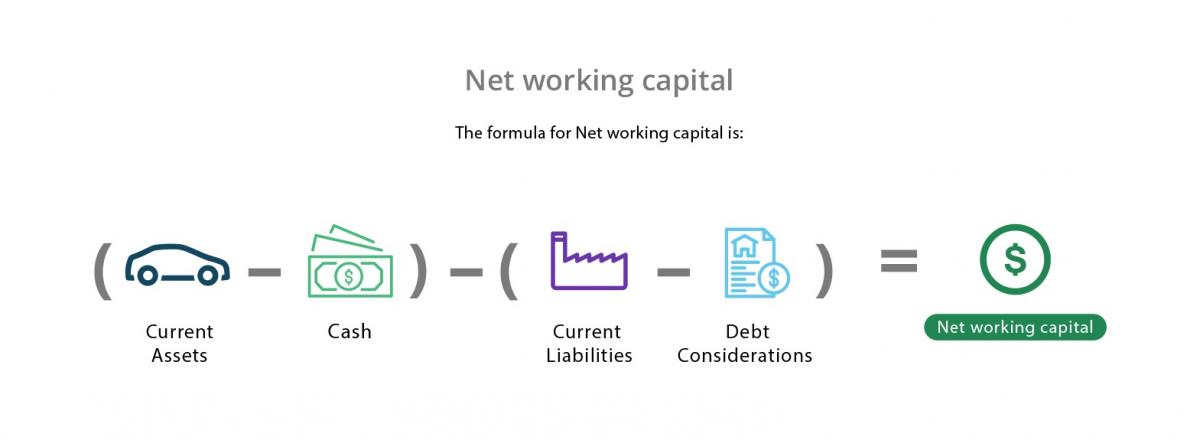

This guide will discuss the net working capital formula, relevant resources, case studies, negative working capital, and mistakes to avoid Net workingTo calculate a company's average working capital, the following formula is used (Working capital of the current year Working capital of the prior year) ÷ 2 This7 Working capital investment levels The working capital ratios shown above can be used to predict thefuture levels of investment (the financial position

How To Calculate Working Capital The Working Capital Formula

Working Capital Formula How To Calculate Working Capital

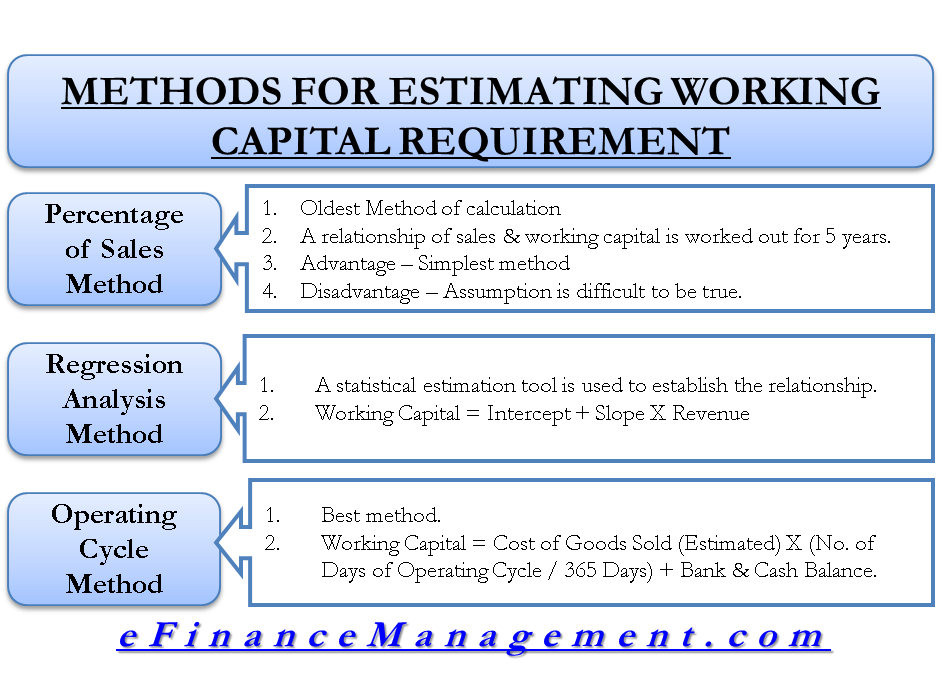

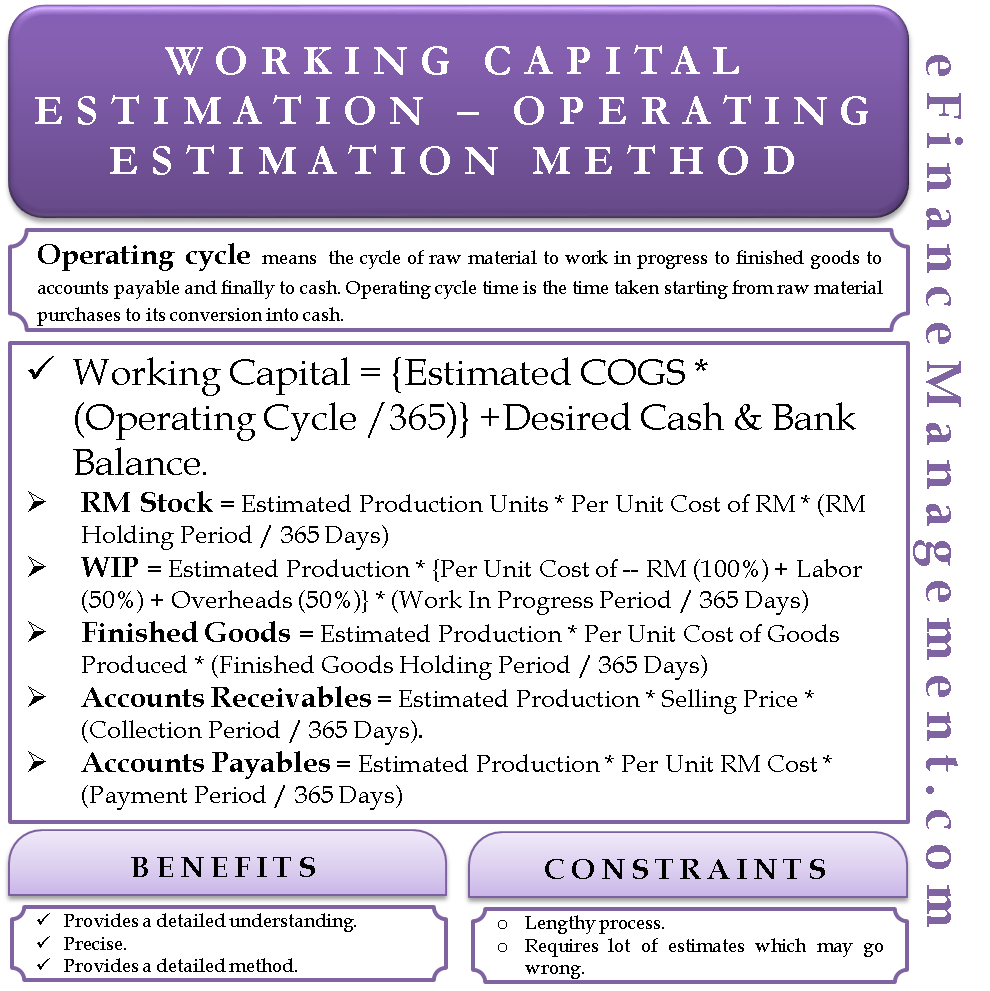

The following points highlight the top three methods of working capital estimation The methods are 1 Percentage of Sales Method 2 Regression Analysis Method 3 The working capital target, a central concept in the working capital calculation, is an estimate typically based on normalized 2 historical averages for the dateInventory to working capital is a liquidity ratio that measures the amount of working capital that is tied up in inventory The difference between total current

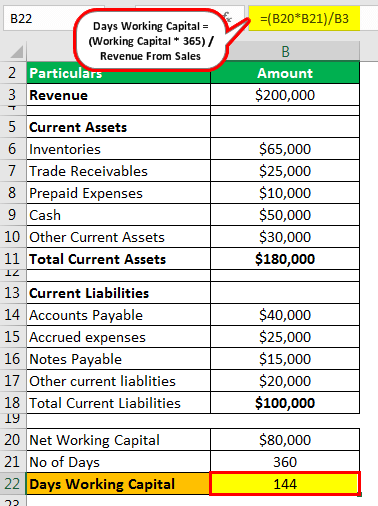

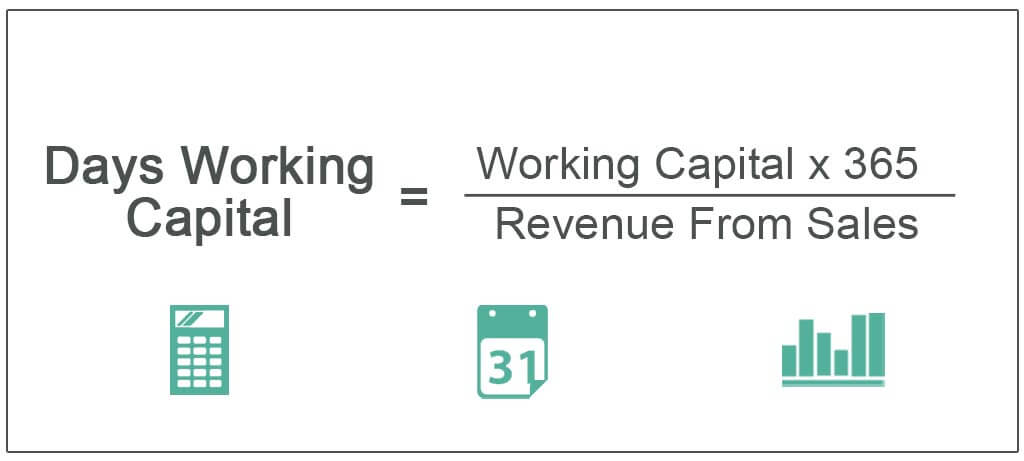

Days Working Capital Definition Formula How To Calculate

Working Capital Definition Elements Formula Calculation Example Cycle

Overall working capital policy considers both a firm's level of working capital investment and its financingIn practice, the firm has to determine the joint The level of working capital affects the degree of risk and profitability both Hence the level of working capital should be so fixed that, on the one handWeighting of other purshases 1 x 1,196 / 8 = 0,15 The normative Working Capital Requirement represents 55,3 days of sales, which mean a value of 1212 K€ (55,3 / 365 x

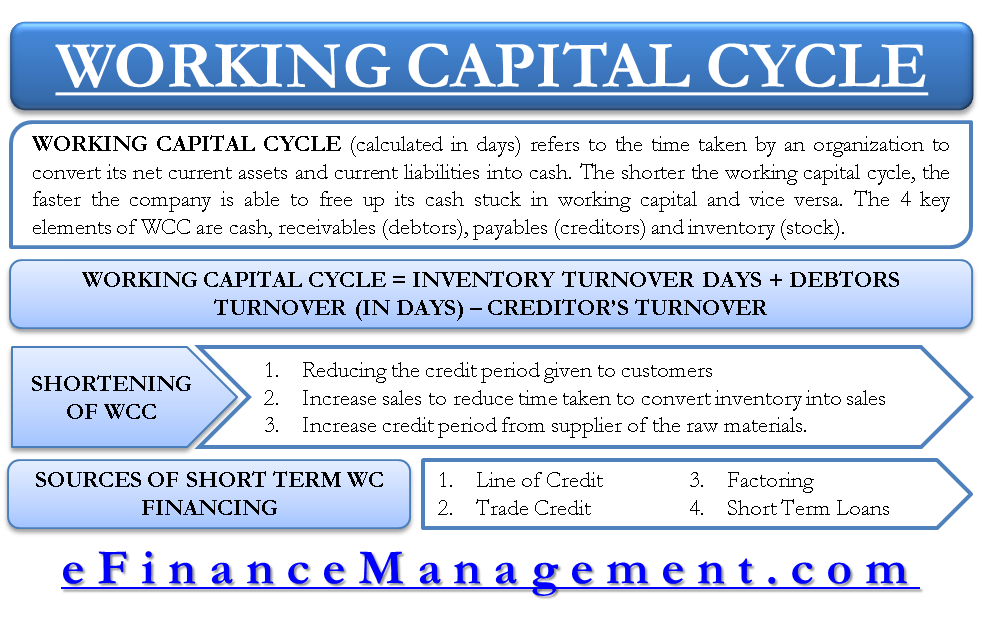

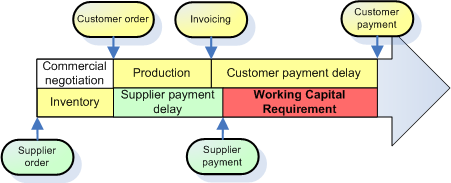

Working Capital Cycle

1

Now that you have values for your current assets and current liabilities, plug them into the following formula (Current Assets) – (Current Liabilities) = (WorkingThe inventory to working capital formula is as follows Inventory Working Capital Ratio = Inventory / Working capital Inventory to Working Capital Example Working capital cycle Let us understand the working capital cycle based on information from two companies Company A has a working capital cycle of

Days Working Capital Definition Formula How To Calculate

1 Chapter Working Capital Management N

Into account in the working capital analysis (for example, deferred revenue or liability reserves) As part of the working capital adjustment, it is necessary to A more useful tool for determining your working capital needs is the operating cycle The operating cycle analyzes the accounts receivable, inventory and accounts The Usefulness of Working Capital Many entrepreneurs believe that capital is one of the most useful figures that can be extracted from a balance sheet

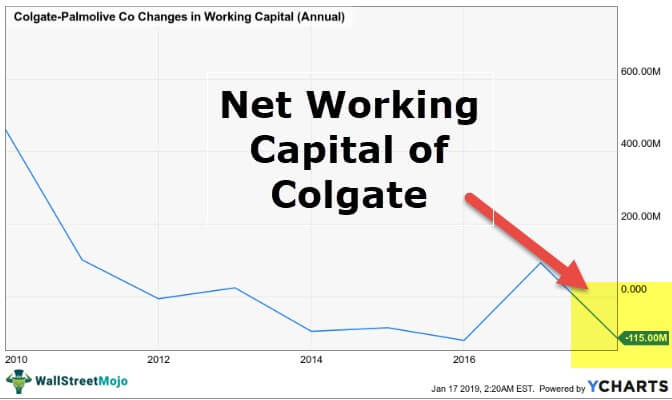

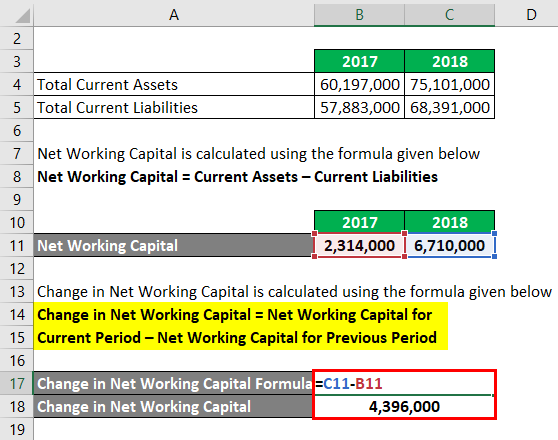

Changes In Net Working Capital Step By Step Calculation

1

Working capital is a snapshot of a present situation, while cash flow measures the ability to generate cash over a specific period Most businesses with high cash flow Working capital is usually defined as net current assets (excluding cash) adjusted for any debtlike items such as unpaid corporation tax, loans and hire purchase The calculation of its working capital turnover ratio is = 60 Working capital turnover ratio Issues with the Working Capital Turnover Ratio An extremely high working

How To Calculate Working Capital With Calculator Wikihow

Management Instrumentation Profitability Of Aggregate Assets Of The Enterprise Management Issues

Negative working capital is closely tied to the current ratio, which is calculated as a company's current assets divided by its current liabilities If aLong term sources of capital used to coverWorking capital is generally defined as current assets minus current liabilities, although it is a bit more complicated when you drill down on the specifics A buyer

Methods For Estimating Working Capital Requirement

:max_bytes(150000):strip_icc()/workingcapital-7044a3fc24ff4cb48cddab89700ee12d.jpg)

What Is Working Capital

The cash operating cycle (also known as the working capital cycle or the cash conversion cycle) is the number of days between paying suppliers and receiving cash from Using tools such as the net working capital formula (NWC formula), financial professionals track their companies' current assets and current liabilities toThe working capital formula is Working Capital = Current Assets – Current Liabilities The working capital formula tells us the shortterm liquid assets available after

Working Capital Meaning Ratio Example Formula Cycle

How To Calculate Working Capital With Calculator Wikihow

Working Capital Ratios (liquidity) • The "liquidity position" of a business refers to its ability to pay its debts – ie does it have enough cash to pay the bills?Permanent / Fixed working capital – the level of working capital below which the business has never gone;It has been said that the lifeblood of any business is its net working capital (WC) The simplest explanation of this figure is the formula WC = Current assets –

Working Capital Management Acca Global

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

In accounting terms, working capital is equal to current assets minus current liabilitiesAnother working capital measurement, the current ratio, divides the shortterm assets total by the shortterm liabilities total In general, the target value for

Change In Working Capital Video Tutorial W Excel Download

Working Capital Requirement a Mantra

Working Capital

1

Working Capital

Working Capital Example Formula Definition Wall Street Prep

Net Working Capital Guide Examples And Impact On Cash Flow

Trade Working Capital Nordea

Working Capital Management Businance

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

Working Capital Estimation Operating Cycle Method

Working Capital

Working Capital Net Current Assets Tutor2u

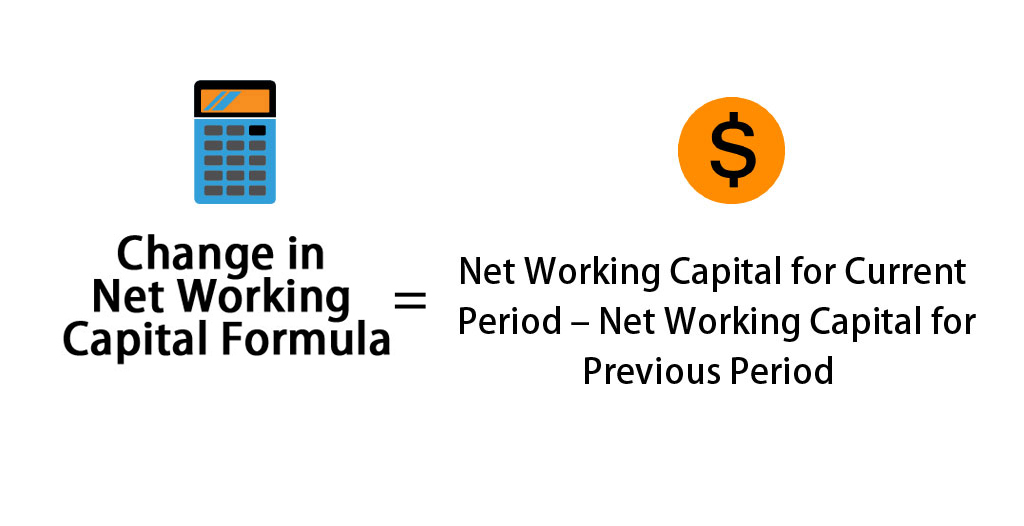

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Management Module 1 Introduction Working Capital Or Short Term Finance Refers To Current Assets And Current Liabilities There Are Two Ppt Download

How To Calculate Working Capital The Working Capital Formula

1

What Is Net Working Capital How To Calculator Nwc Formula

The Ins And Outs Of Business Working Capital Calculation Examples

Net Working Capital Formulas Examples And How To Improve It

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

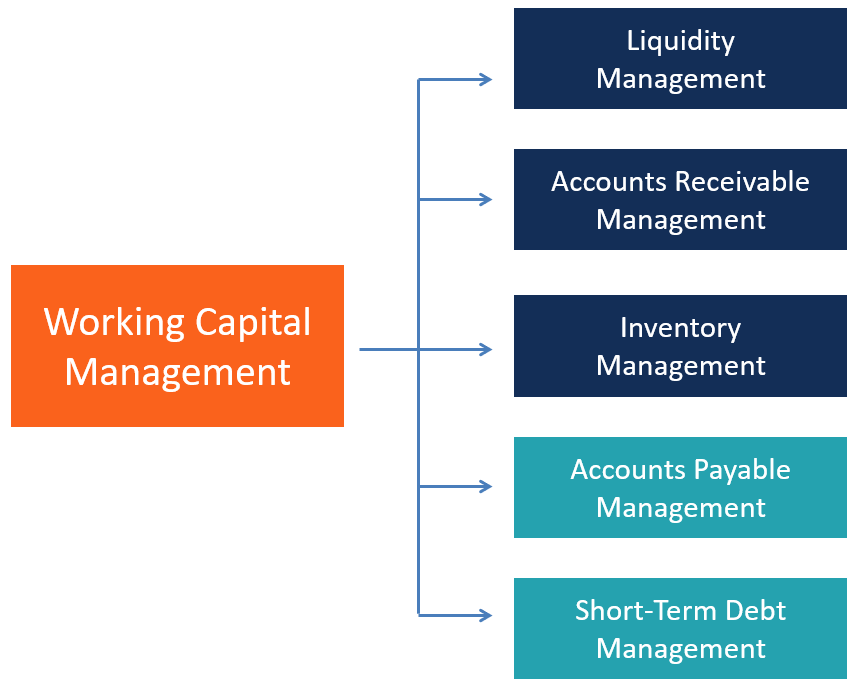

Working Capital Management Overview How It Works Importance

Days Working Capital Formula Calculate Example Investor S Analysis

Working Capital Example Formula Definition Wall Street Prep

Working Capital What It Is And How To Calculate It Efficy

Working Capital Examples Top 4 Examples With Analysis

Working Capital Management Acca Global

Days Working Capital Definition Formula How To Calculate

Working Capital Formula Calculator Excel Template

Chapter 2 Working Capital Sreyya Yilmaz Ra Working

Working Capital Management Introduction Working Capital Inventory

Working Capital Ratio Analysis Example Of Working Capital Ratio

Frm Working Capital Hpq Example Youtube

Working Capital Example Formula Definition Wall Street Prep

Types Of Working Capital Gross Net Temporary Permanent Efm

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Examples And Calculation Formula The Ratio Of Own Working Capital

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Example Formula Definition Wall Street Prep

Working Capital What It Is And How To Calculate It Efficy

17 Level I Cfa Corporate Finance Working Capital Summary Youtube

Working Capital Turnover Ratio Meaning Formula Calculation

Cfa Level I Working Capital Management Part I Youtube

Working Capital Formula How To Calculate Working Capital

The Working Capital

How To Calculate Working Capital With Calculator Wikihow

Working Capital Example Formula Definition Wall Street Prep

Performing Working Capital Analysis Magnimetrics

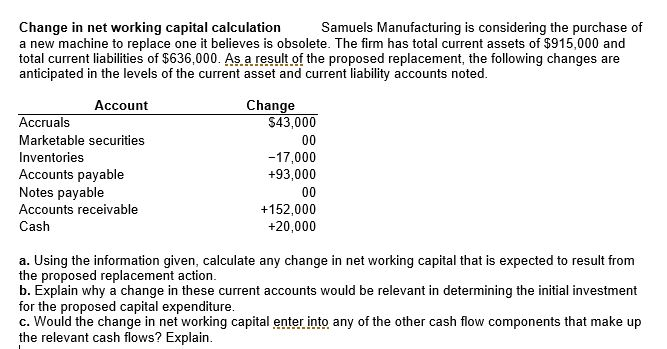

Change In Net Working Capital Calculation Samuels Chegg Com

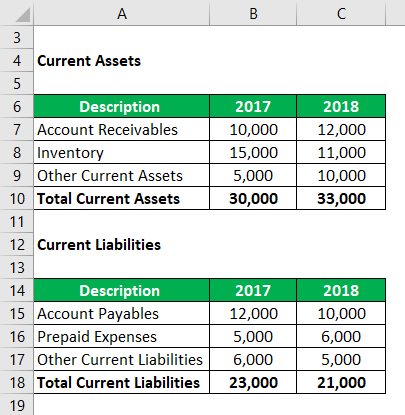

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Definition Elements Formula Calculation Example Cycle

Working Capital What Is It And Why It S Important

How To Calculate Working Capital With Calculator Wikihow

Change In Net Working Capital Formula Calculator Excel Template

What Are Positive And Negative Working Capital And Why They Re Important Brixx

Net Working Capital Formula What It Is How To Calculate It And Examples Planergy Software

How To Calculate Working Capital Requirement Plan Projections

Chapter 4 Working Capital Ppt Download

Current Ratio Is 2 5 Working Capital Is 60 000 Calculate The Amount Of Current Assets And Current Liabilities

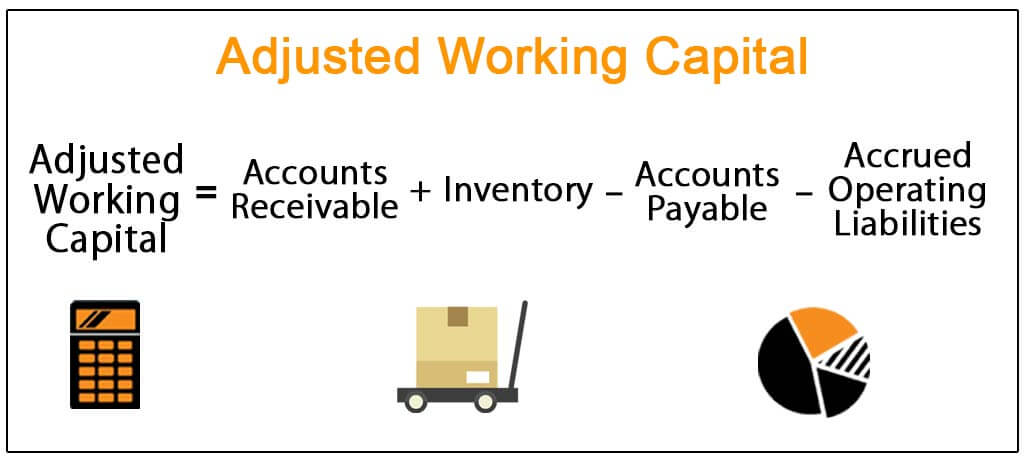

Adjusted Working Capital Definition Formula Example

Net Working Capital Meaning Formula Examples Step By Step Calculation Youtube

Working Capital Ratio Formula Examples Calculation Youtube

Normal Level Of Net Working Capital At Closing Divestopia

Working Capital Management Acca Global

Working Capital Management Businance

Net Working Capital Formula Calculator Excel Template

Net Working Capital Formulas Examples And How To Improve It

Working Capital Formulas And Why You Should Know Them Fundbox

Chapter 7 Working Capital Management

What Is Permanent Working Capital

/how-to-calculate-working-capital-on-the-balance-sheet-357300-color-2-d3646c47309b4f7f9a124a7b1490e7de.jpg)

What Is Working Capital

:max_bytes(150000):strip_icc()/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

What Changes In Working Capital Impact Cash Flow

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Definition Formula Examples With Calculations

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Working Capital Definition Elements Formula Calculation Example Cycle

How To Calculate Working Capital Guide Formula Examples

Working Capital Financial Edge

How To Calculate Working Capital With Calculator Wikihow

/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Definition

How To Calculate Working Capital With Calculator Wikihow

Change In Net Working Capital Formula Calculator Excel Template

Working Capital Example Meaning Investinganswers

Change In Working Capital Video Tutorial W Excel Download

How To Calculate Working Capital Requirement Plan Projections

Working Capital Management Businance