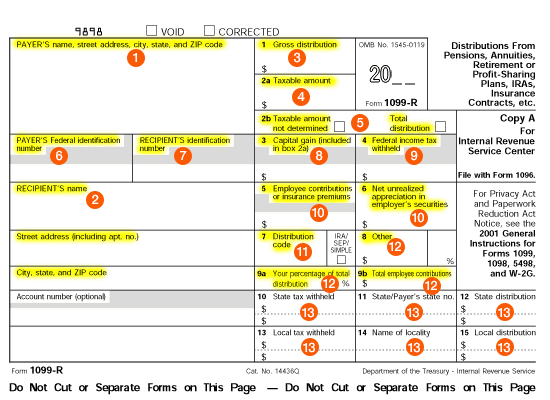

Did you receive Form 1099G for unemployment income that you didn't receive?Specific Instructions for Form 1099R File Form 1099R, Distributions From Pensions, Annuities, Retirement or ProfitSharing Plans, IRAs, Insurance Contracts, etc, for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from profitsharing or retirement plans, any individual retirement arrangements (IRAs), annuitiesJun 05, 19 · Is there a difference between 1099 and 1099r There is more than one type of 1099 A 1099R reports retirement income and retirement account transactions, such as an IRA, a 1099Misc reports miscellaneous income such as paying a contractor and a 1099Q reports an education accoount distribution to name a few 0

How To Read Your Brokerage 1099 Tax Form Youtube

1099 composite vs 1099 r

1099 composite vs 1099 r-Jul 27, 17 · When you receive a 1099C or 1099S, you must use tax form 1040 to report the income Generally, you will report the amount in box 2 in the line titled "Other Income" on form 1040 If you received both a 1099C and a 1099S, add the amount of form 1099C, box 2 and form 1099S, box 2 together and enter the total in the line titled "Other Income"Your Form 1099 The Basics The 1099 form, by contrast, records income you received as an independent contractor or for some other source of income For example, if you're a freelancer or own your own business, you'll likely receive several 1099 forms from your clients The IRS requires businesses to issue a form 1099 if they've paid you at least $600 that year

Tax Information Arizona State Retirement System

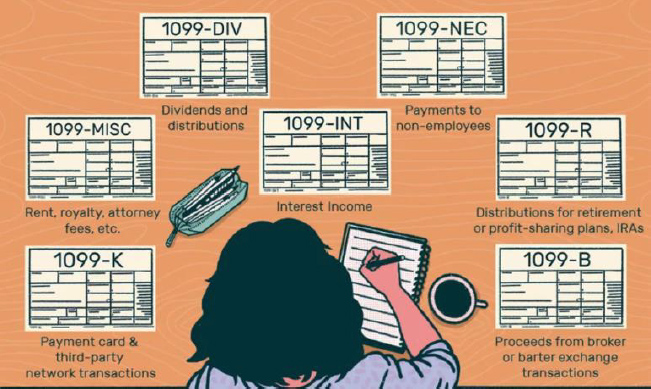

A 1099MISC is a 1099 form that you are probably used to hearing about If you hire someone who is not an actual permanent member of your staff to do something for your business, you will probably issue a 1099MISC to both the contractor and to the IRS by January 31 of the year after the work is performedJan 28, 19 · There are many varieties, including 1099INT for interest, 1099DIV for dividends, 1099G for tax refunds, 1099R for pensions, and 1099MISC for miscellaneous income Sometimes, you even receiveA 1099R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts You'll generally receive one for distributions of $10 or more The plan or account custodian completing the 1099R must fill out three copies of every 1099R they issue

There are two types of 1099s, 1099INT and 1099R While both forms report income that is generated by an insurance policy, Form 1099INT is used to report interest credited on certain policy proceeds Form 1099R is used to report designated distributions of a policy's internal earnings (gain) that were previously untaxed Events that Can Generate a 1099INTForm 1099MISC and Form 1099K appear the same, but they serve different purposes To correctly report your income this coming tax season, it's important to understand what each of those forms tells you Form 1099MISC and Form 1099K both report income Form 1099MISC and Form 1099K report business income you received during the tax yearLearn more about investment amounts realized on IRS Form 1099B and get tax answers at H&R Block

Index Fund Advisors, Inc (IFA) is a feeonly advisory and wealth management firm that provides riskappropriate, returnsoptimized, globallydiversified and taxmanaged investment strategies with a fiduciary standard of care Founded in 1999, IFA is a Registered Investment Adviser with the US Securities and Exchange Commission that provides investment advice to individuals, trustsNov 29, 19 · When you are selfemployed or working on a contract basis without withholding the taxes, then your income will be reported under different tax forms like 1099 MISC Form or 1099 K Form Consultants or freelancers who receive $600 or more during a tax year can receive 1099 MISC form, on the other hand a freelancer who works ondemand economy such as Lyft or Uber will receive 1099Composite 1099 Tax Statement (the Statement _) The Statement is a permitted substitute for official IRS forms and also includes supplemental information Among the forms that may be included on the Composite Statement that HilltopSecurities provides are Form 1099B

How To Read Your Brokerage 1099 Tax Form Youtube

What Is A 1099 Irs Tax Form 1099 Int 1099 R Ssa 1099 Variants

Form 1099R is an IRS tax form used to report distributions from annuities, profitsharing plans, retirement plans, or insurance contracts more Form 1099DIV Dividends and DistributionsWhile there are nearly two dozen variations on form 1099, the most common ones are 1099INT, 1099R, and SSA1099 Another version you'll see often is the 1099MISC , which businesses use for payments that don't fall under the other 1099 categoriesSometimes, the individual sections of the composite forms do not include all of the information that is available on a standard 1099 form, such as the check boxes for shortterm and longterm transactions on the standard 1099B form Instead, many of these composite forms simply group the different types of transactions so that you can readily

How To Print And File 1099 R

Chevy Chase Trust Account Information

Jun 27, 19 · In the form 1099C, there are many concessions revealed regarding the amounts and the group of people whereas in the form 1099A there are no exceptions declared concerning the behavior For the behavior of 1099C, the record of the data for the last four years is compulsory, whereas for 1099A no such limit is smearsA 1099C is a notice to the IRS that the financial institution has forgiven or canceled a debt of $600 or more See the IRS Instructions for Forms 1099A and 1099C and IRS Form 9 to learn more If the financial institution issues a 1099C to you, then it has forgiven the debt and you must report the amount on the 1099C as incomeForm 1099R is an IRS tax form used to report distributions from annuities, profitsharing plans, retirement plans, or insurance contracts more Form 1099

What Is An Irs 1099 Form Definition Form Differences The Turbotax Blog

Looking For Your Vanguard Tax Forms Vanguard

Feb 13, · 1099 Composite Help So you received your tax documents from your broker or financial advisor either online or in a fat envelope in the mail You open it up and it is page after page of tables and footnotes with labels and numbers, and you wonder how you are ever going to make heads or tails of itInf brochur repr underst curr t regar inf r R 2 epresentativ o ec of or ormation TABLE OF CONTENTS Overview 3 Composite Statement Mailing Groups 4 Changes for 17 5 •Form 1099INT 5 •Form 1099OID 6 • Amended Forms 7 Composite Statement Overview and Instructions 8Apr 24, 21 · 1099R and 1099DIV are primarily for documentation (to support your tax filing in the event of audit) Generally, the IRS is also sent a copy of the 1099 directly from the investment company where you hold your investments Therefore, the various types of form 1099 are for the taxpayer's records, in the event of audit in the future

:max_bytes(150000):strip_icc()/1099misc-640a2c257de14027971a0751a2d8bd29.jpg)

Form 1099 Definition

Tax Information Center Fidelity Institutional

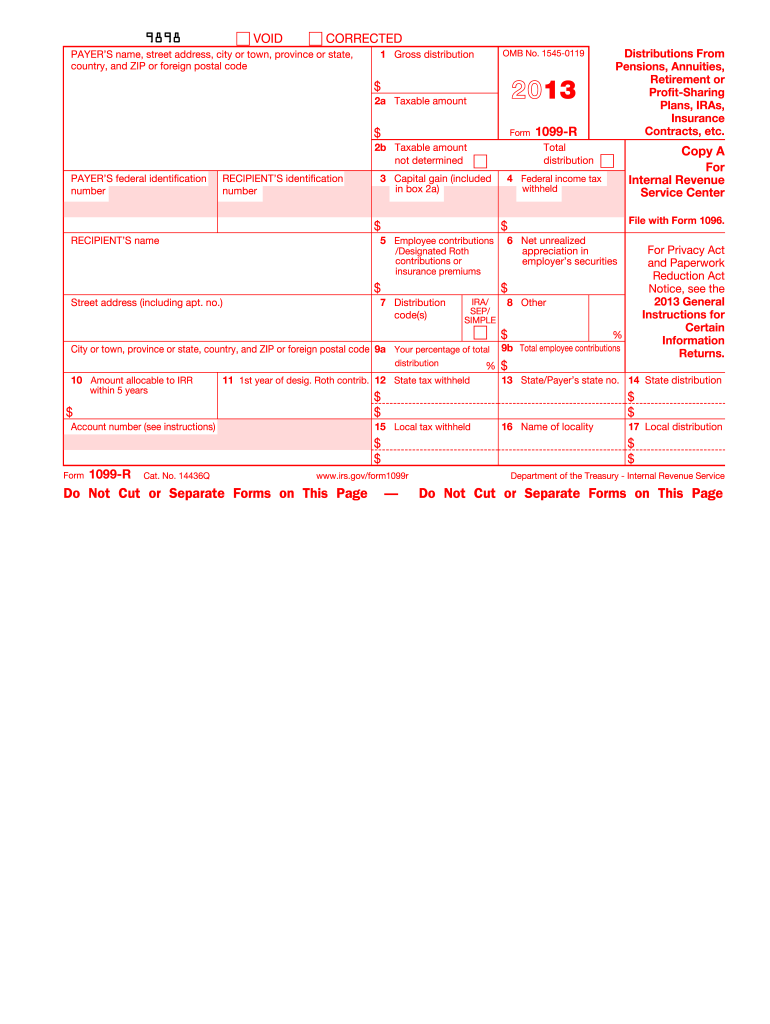

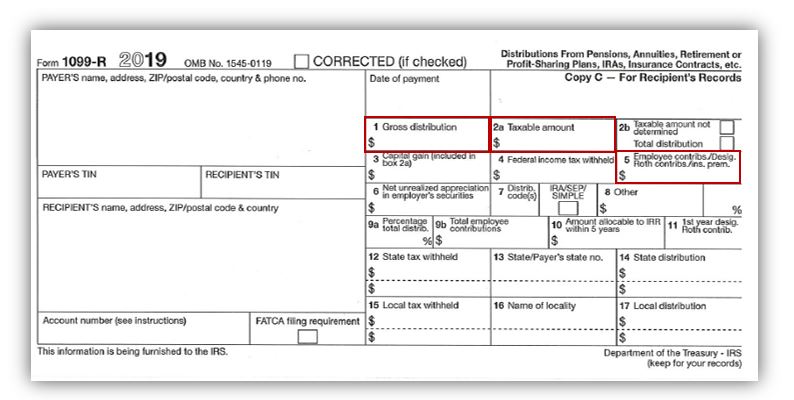

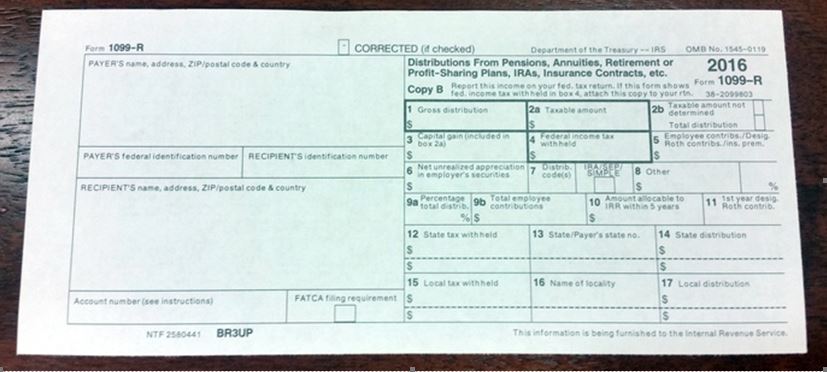

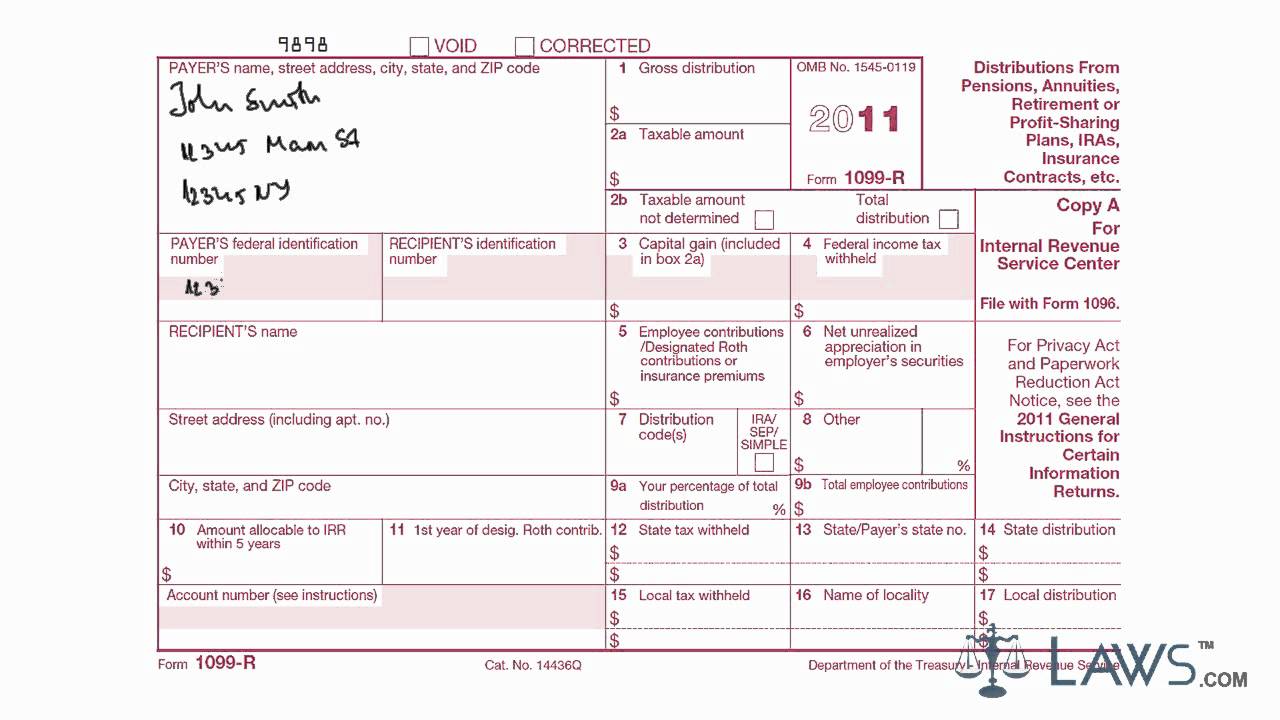

Form 1099R is used to report distributions from annuities, profitsharing plans, retirement plans, IRAs, insurance contracts, or pensions Anyone who receives a distribution over $10 requires aFeb 18, 21 · Form 1099R also reports profitsharing and pension plan distributions, payments resulting from insurance contracts, survivor benefits, and those received from annuities If any federal tax was withheld from any of these payments, it is also reported on the 1099Jan 31, 19 · I just received Form 1099 Composite and/or Year End Summary documents, prepared on JANUARY 25, 19, i sold a few very small shares that i bought this year 19 the timing doesn't matter as i had the for a week and decided to sell them for a better stockBut the bulk of my stocks which was bought in Oct 18 i still held on to i only sold one stock which was

Benefits 1099 R

Deadline For Forms 1099 Misc And 1099 Nec Is Feb 1 21 Cpa Practice Advisor

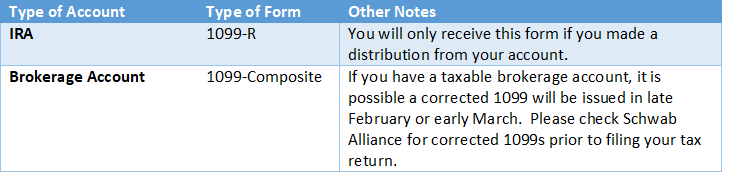

Form 1099INT provides your interest earnings on savings, checking and money market fund accounts If you earned more than $10 in interest in a tax year asNov , 13 · Form 1099DIV Banks and other financial institutions use it to report investment income Form 1099INT This is to report interest income Form 1099G This lists government payments like unemployment benefits and tax refunds Form 1099R This documents payments from annuities, pensions, retirement plans and profitsharing plans1099 Brokerage accounts This form reports any income generated by your account, and may include IRS Form(s) 1099B, 1099DIV, 1099INT, 1099MISC and 1099OID, depending on your situation Email 1 early February Email 2 later February Log into your account online 1099R Retirement accounts This form reports distributions from IRA and

How To Report Section 1256 Contracts Tastyworks

1099 Forms In View 1099div 1099g 1099int 1099m 1099r

Form 1099 is one of several IRS tax forms (see the variants section) used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips (for which Form W2 is used instead) The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kindsH&R Block® • Janney clients have the ability to import their 1099 Tax Form data directly into H&R Block® software which will provide clients the benefit of saving valuable time and effort as the information will not have to be manually entered • H&R Block® is aForm 1099R is an IRS tax form used to report distributions from annuities, profitsharing plans, retirement plans, or insurance contracts more Form 1099

1099 R 17 Public Documents 1099 Pro Wiki

Tax Information Center Fidelity Institutional

Apr 02, 21 · Here are the key differences between tax forms 1099NEC and 1099MISC If you were selfemployed in , you may have received Form 1099NEC, Nonemployee Compensation, instead of Form 1099MISCMar 08, 21 · All Revisions for Form 1099R and Instructions Online Ordering for Information Returns and Employer Returns Publication 12 PDF, Specifications for Filing Forms 1097,1098, 1099, 3921, 3922, 5498, 35,and W2G Electronically (PDF) Additional Publications You May Find Useful Other Current ProductsForm 1099R Form 1099R is used to report distributions from pensions, annuities, retirement or profitsharing plans, IRAs, and insurance contracts You may also receive Forms SSA1099, RRB1099, or RRB1099R from the Social Security Administration or Railroad Retirement Board to report the benefits you received during the year

Don T Overpay Your Taxes Learn The Cost Basis Facts For Stock Plans Pdf Free Download

Tax Information Arizona State Retirement System

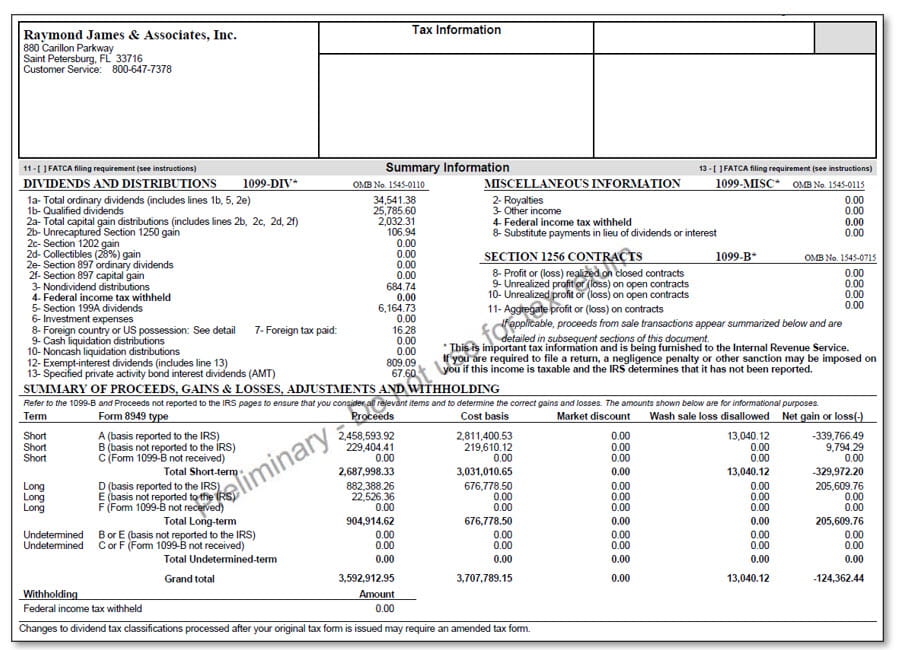

The Composite 1099 Form is a consolidation of various Forms 1099 and summarizes relevant account information for the past year This includes the associated cost basis related to those transactions The following pages will outline these responsibilities in detail, along with aAug 10, · Note that filing a 1099 and a W2 for the same worker could result in a tax audit The IRS will perform such audits on employers if they suspect someone has misclassified an employee The tax differences between W2s and 1099s Your tax obligations vary between 1099 contractors and W2 employees You pay 1099 workers per the terms of theirApr 29, 21 · Many taxpayers are stumped by Form 1099K Find 1099 k instructions and helpful information in this easytoread article from H&R Block

13 Form Irs 1099 R Fill Online Printable Fillable Blank Pdffiller

Breaking Down Form 1099 Div Novel Investor

States are reporting an uptick in fraudulent claims If you were a victim of unemployment identity theft and received Form 1099G (with an amount in Box 1), you should Contact the 1099G issuer for a corrected form showing $0 benefits receivedIt is our pleasure to provide you with the Raymond James 19 Guide to your Composite Statement of 1099 Forms This guide is designed to help you understand your Composite Statement, which consolidates various Forms 1099 and summarizes relevant account information for the past yearFeb 17, 17 · Next, Form 1099 C If you receive a 1099 C for a foreclosed property, you should not (but may) receive a 1099 A Because the 1099 C has the same information as 1099 A, and also includes the additional information that the debt has been cancelled Cancelled debt may require the borrower to report the cancelled amount as income

Tax Prep Tips 1099 Tracking Reporting Bogart Wealth

How To Read Your 1099 Robinhood

COMPOSITE STATEMENT OF 1099 FORMS 18 TATEMENT inf brochur repr underst curr t regar inf r R 2 epresentativ o ec of or ormation TABLE OF CONTENTS Overview 3 Composite Statement Mailing Groups 4 Changes for 18 5 • Form 1099DIVDec 21, · What is a 1099R?

What If I Didn T Receive A 1099 The Motley Fool

Form 1099 R Instructions Information Community Tax

Important Tax Information 18 Level Financial Advisors

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

E File 1099 R Form 1099 R Online How To File 1099 R

A Comprehensive Guide To Your Composite 1099 Tax Statement Pdf Free Download

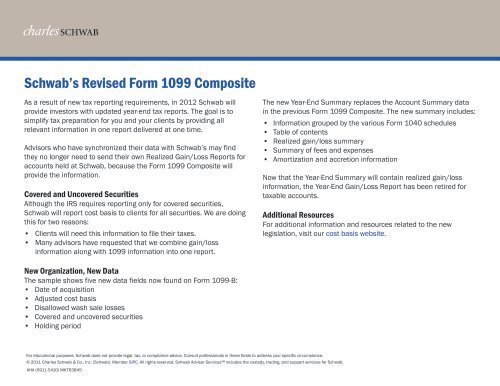

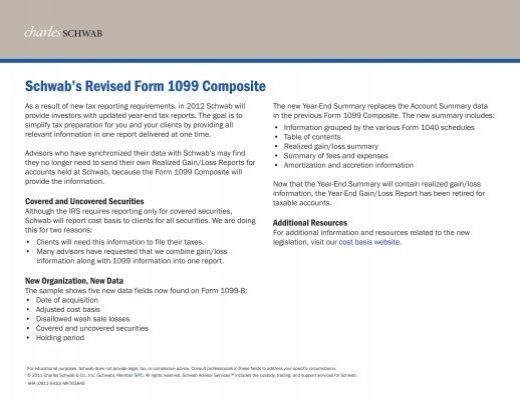

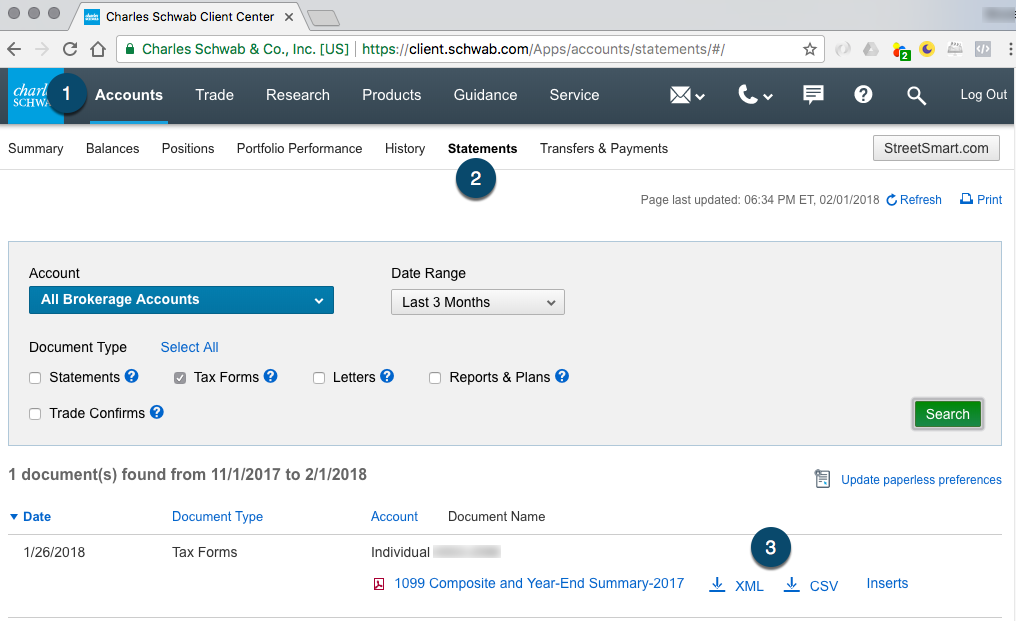

Schwab S Revised Form 1099 Composite Charles Schwab

Understanding Your 1099 R Form Kcpsrs

Tax Prep Tips 1099 Tracking Reporting Bogart Wealth

Schwab One Account Of Account Number Tax Year Form 1099 Composite May Include The Following Internal Revenue Service Irs Forms 1099 Div 1099 Int 1099 Misc 1099 B And 1099 Oid Pdf Document

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Understanding Your 1099 R Form Kcpsrs

1099 R Form Copy D 1 Payer State Discount Tax Forms

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Form Ssa 1099 What Everyone On Social Security Should Know The Motley Fool

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Tax Information Center Fidelity Institutional

:max_bytes(150000):strip_icc()/1099int-8fb1a017591b4432900f3f867e488123.jpg)

Form 1099 Definition

Understanding Your Tax Forms 16 1099 B Proceeds From Broker Barter Exchange Transactions

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

A Comprehensive Guide To Your Composite 1099 Tax Statement Pdf Free Download

Chevy Chase Trust Account Information

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

6 Types Of 1099 Forms You Should Know About The Motley Fool

Form 1099 R Youtube

Form 1099 R Instructions 401k Fedforms

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Schwab S Revised Form 1099 Composite Charles Schwab

Online Generation Of Schedule D And Form 49 For Clients Of Schwab

What Is A 1099 Form H R Block

The Most Common Tax Form Questions Betterment

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

Tax Reporting Client Resources Raymond James

1099 Forms In View 1099div 1099g 1099int 1099m 1099r

Tax Information Center Fidelity Institutional

18 Forms 5498 1099 R Come With A Few New Requirements Ascensus

Form 1099 The Frustrations Of Form 1099 Tax Time

Form 1099 R Wikipedia

Understanding Your 18 1099 R Kcpsrs

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Cost Basis Legislation And Tax Reporting Charles Schwab

Form 1099 R Wikipedia